Travis County Appraisal District: Your Comprehensive Guide To Property Taxes And Valuation

Understanding the Travis County Appraisal District (TCAD) is crucial for homeowners, investors, and businesses in Texas. This organization plays a pivotal role in property valuation and taxation, ensuring a fair and equitable system for all residents. Whether you're a new homeowner or a seasoned real estate professional, TCAD's processes and guidelines directly impact your financial decisions.

The Travis County Appraisal District serves as the backbone of property taxation in Central Texas. Its primary responsibility is to assess property values accurately and provide transparent information to property owners. By understanding TCAD's role, you can better navigate the complexities of property taxes and make informed decisions about your real estate investments.

In this article, we will explore the functions, processes, and significance of the Travis County Appraisal District. From understanding property appraisal methods to navigating appeals and exemptions, this guide will provide you with the tools and knowledge needed to manage your property tax obligations effectively.

Read also:Good Friday Memes 2024 A Comprehensive Guide To Celebrating With Humor

Table of Contents

- What is Travis County Appraisal District?

- The Role of TCAD in Property Taxation

- The Property Appraisal Process

- Factors Affecting Property Appraisal

- Understanding Tax Exemptions

- How to Appeal Your Appraisal Value

- Important Dates and Deadlines

- Resources for Homeowners

- Impact on Property Owners

- Conclusion and Call to Action

What is Travis County Appraisal District?

The Travis County Appraisal District (TCAD) is an independent entity responsible for determining the value of all taxable properties within Travis County, Texas. Established under Texas law, TCAD ensures that property taxes are assessed fairly and equitably. This district operates as a local government agency, working closely with taxing entities such as schools, cities, and counties to collect property tax revenue.

Key Responsibilities of TCAD

TCAD's primary duties include:

- Identifying and valuing all taxable properties in Travis County

- Maintaining accurate property records

- Handling property tax appeals and disputes

- Providing property owners with transparency and access to information

By fulfilling these responsibilities, TCAD plays a vital role in supporting local governments and ensuring that property owners contribute their fair share to public services.

The Role of TCAD in Property Taxation

The Travis County Appraisal District serves as the foundation of the property tax system in Travis County. It collaborates with various taxing entities to determine the tax rates applied to properties based on their assessed values. Understanding this relationship is essential for property owners to comprehend how their tax bills are calculated.

How Property Taxes are Calculated

Property taxes are determined using the following formula:

Assessed Value × Tax Rate = Tax Amount

Read also:Melanie Griffithovaacute A Comprehensive Look At The Life And Career Of A Hollywood Icon

TCAD provides the assessed value, while the taxing entities set the tax rates. This collaboration ensures that funds are allocated appropriately for public services such as schools, emergency services, and infrastructure.

The Property Appraisal Process

The property appraisal process involves several steps to ensure accurate and fair valuation. TCAD utilizes advanced tools and methodologies to assess property values, taking into account various factors that influence market conditions.

Steps in the Appraisal Process

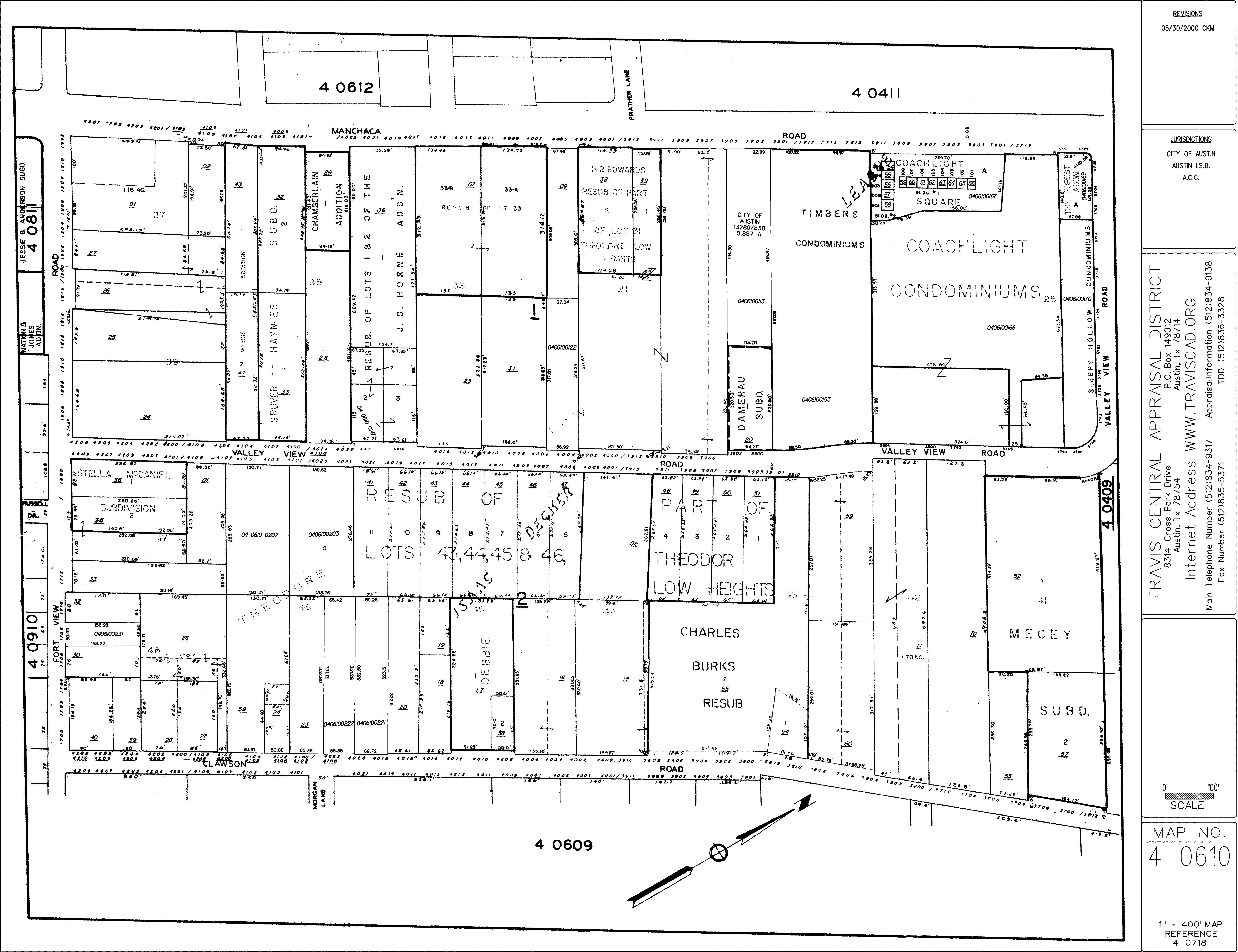

- Identification: TCAD identifies all properties within its jurisdiction and assigns unique parcel numbers.

- Inspection: Appraisers conduct property inspections to gather detailed information about the property's characteristics.

- Valuation: Using market data, cost analysis, and income approaches, TCAD determines the property's market value.

- Notification: Property owners receive an appraisal notice informing them of their property's assessed value.

This systematic approach ensures that property values are assessed consistently and fairly across the county.

Factors Affecting Property Appraisal

Several factors influence the appraisal value of a property. Understanding these factors can help property owners anticipate changes in their assessed values and prepare for potential tax implications.

Key Factors Considered by TCAD

- Location and neighborhood characteristics

- Property size and improvements

- Market trends and economic conditions

- Recent sales of comparable properties

By considering these factors, TCAD strives to provide accurate and equitable property valuations that reflect current market conditions.

Understanding Tax Exemptions

Tax exemptions can significantly reduce property tax obligations for eligible property owners. The Travis County Appraisal District offers various exemptions to qualifying individuals and organizations, providing financial relief and encouraging community development.

Common Tax Exemptions

- Homestead Exemption: Available to homeowners who use their property as their primary residence.

- Over-65 Exemption: Provides additional relief for homeowners aged 65 and older.

- Disability Exemption: Offered to individuals with qualifying disabilities.

- Energy Efficiency Exemption: Encourages the adoption of sustainable practices by reducing tax burdens for energy-efficient properties.

Property owners should explore available exemptions and apply for them through TCAD to maximize their tax savings.

How to Appeal Your Appraisal Value

If you believe your property's assessed value is inaccurate, you have the right to appeal. The Travis County Appraisal District provides a formal process for property owners to challenge their appraisals and seek adjustments.

Steps to Appeal Your Appraisal

- Review your appraisal notice and gather supporting documentation.

- Submit a protest form to TCAD within the specified deadline.

- Attend a hearing with the Appraisal Review Board (ARB) to present your case.

- Receive a decision from the ARB and, if necessary, pursue further legal action.

By following these steps, property owners can ensure that their concerns are addressed and their property values are reassessed fairly.

Important Dates and Deadlines

Timely compliance with TCAD's deadlines is crucial to avoid penalties and ensure your rights are protected. Below are key dates and deadlines property owners should be aware of:

- January 1: Taxable property ownership is determined as of this date.

- May 15: Deadline for filing homestead exemption applications.

- May 31: Deadline for filing protests against appraisal values.

- October 31: Final deadline for property tax payments to avoid penalties.

Staying informed about these dates will help you manage your property tax obligations effectively.

Resources for Homeowners

The Travis County Appraisal District offers a wealth of resources to assist property owners in understanding and managing their tax responsibilities. These resources include online tools, guides, and contact information for support.

Online Tools and Guides

- TCAD Official Website: Access property records, tax information, and forms.

- Property Search Tool: Locate detailed information about your property and its assessed value.

- Educational Guides: Download guides on exemptions, appeals, and other important topics.

Utilizing these resources can empower property owners to make informed decisions about their real estate investments.

Impact on Property Owners

The Travis County Appraisal District's activities have a direct impact on property owners in Travis County. Accurate property valuations and transparent processes are essential for maintaining trust and ensuring fairness in the tax system.

Property owners should stay engaged with TCAD by monitoring their appraisal notices, exploring available exemptions, and participating in the appeals process if necessary. By doing so, they can protect their financial interests and contribute to the community's growth and development.

Conclusion and Call to Action

The Travis County Appraisal District plays a critical role in shaping the property tax landscape in Central Texas. By understanding its functions, processes, and resources, property owners can navigate the complexities of property taxation with confidence. Whether you're applying for exemptions, appealing your appraisal value, or simply seeking information, TCAD provides the tools and support needed to manage your tax obligations effectively.

We encourage you to explore the resources provided by TCAD and stay informed about important dates and deadlines. Share this article with fellow property owners and engage with us by leaving comments or questions below. Together, we can build a community that values transparency, fairness, and accountability in property taxation.

Sources:

- Travis County Appraisal District Official Website

- Texas Comptroller of Public Accounts: Property Tax Guide

- Texas Property Tax Code